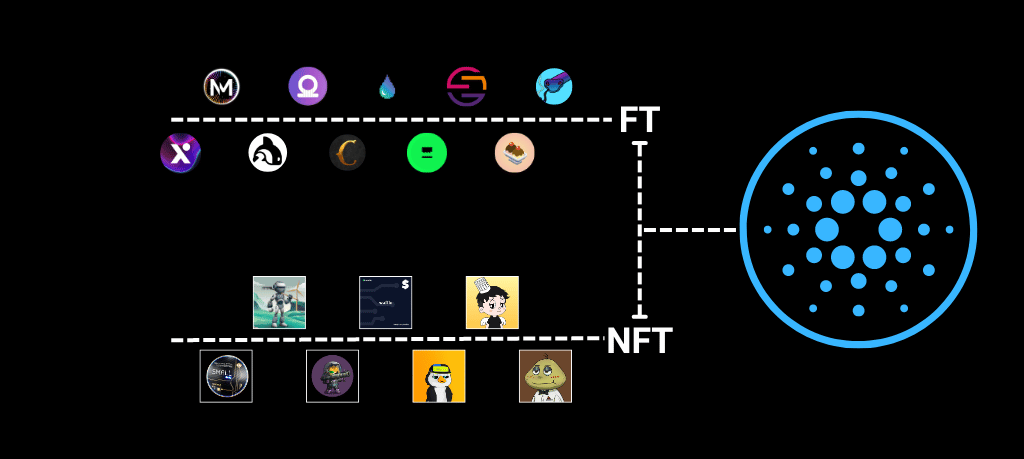

After the Mary hard fork in February 2021, the Cardano blockchain expanded its capabilities to become a multi-asset ledger. This significant upgrade facilitated the creation and use of tokens and NFTs that function on Cardano's layer-1 blockchain, much like ADA, Cardano's base currency. Among these tokens, some hold no market value, while others boast market caps worth millions, as showcased on TapTools. Distinct from Ethereum and EVM-compatible chains, which necessitate smart contracts for token management (commonly known as ERC-20 tokens), CNTs are directly integrated into the blockchain. This direct integration not only simplifies the token creation process but also enhances transaction efficiency and security.

Multi-Asset (MA) Support in Cardano

The multi-asset (MA) support in Cardano's ledger inherently extends its functionalities beyond merely handling ADA transactions. This design allows the network to innately track the transfer and ownership of a wide array of assets. Enabled by the native tokens functionality, Cardano's ledger model seamlessly encompasses both ADA and an array of user-defined custom token types, enriching the ecosystem and offering extensive asset diversity.

Understanding Native vs. Non-native MA Support

Cardano differentiates itself with native MA support, providing built-in capabilities for tracking the ownership and transfer of multiple asset types directly on its ledger. This approach contrasts sharply with non-native MA support, which relies on layer-2 solutions and smart contracts to track additional asset types, introducing unnecessary complexity and potential security concerns.

Cardano Native Tokens: Operation and Integration

Cardano sets itself apart by integrating native tokens (CNTs) directly into its blockchain, treating them akin to ADA, its primary currency. However, a distinct feature of CNT transactions is the requirement of ADA for transaction facilitation, a measure that guarantees network operability. This direct integration eliminates the need for external smart contracts for basic token functions, though the option remains for deploying more intricate operations. The ADA amount required to send CNTs varies depending on how many different CNTs are being sent in that one transaction.

Minting Policies and Asset Identification

A standout feature of CNTs is the minting policy, which acts as a token's monetary policy, detailing the rules for a token's creation and destruction. These policies define the token's total supply, who can mint or burn the tokens, and the timeframes for these actions. Once a specified period ends, these policies become immutable, securing the rules governing a token's supply and management. Importantly, both fungible tokens (FTs) and non-fungible tokens (NFTs) on Cardano are identifiable on-chain by their policy ID and asset names, ensuring clear identification and distinction among assets.

For instance, a minting policy designed for the issuance of 1,000,000 "WaffleCoin" tokens, with options for future adjustments to the supply, might look like this:

{

policy_id: "examplePolicyID123",

mintableAmounts: {"WaffleCoin": 1000000},

conditions: {

canMint: ["walletAddress1", "walletAddress2"],

canBurn: ["walletAddress1"],

expiry: "2025-06-04T00:00:00Z"

}

}(Note: This is a simplified example for demonstration purposes.)

NFTs on Cardano

In addition to fungible tokens (FTs), Cardano also supports the creation of Non-Fungible Tokens (NFTs), which are governed by minting policies similar to FTs but typically have a quantity of one making it ideal for representing unique digital assets.

An example of an NFT minting policy for a unique digital waffle artwork might be:

{

policy_id: "waffleArtPolicyID456",

mintableAmounts: {"waffleArt": 1},

conditions: {

canMint: ["artistWalletAddress"],

canBurn: ["artistWalletAddress"],

expiry: "2025-06-04T00:00:00Z"

}

}(Note: This is a simplified example for demonstration purposes.)

Metadata for NFTs, including details such as the token name, symbol, and imagery, is defined in a separate metadata.json file, adhering to standards like CIP-25, ensuring consistency and interoperability within the Cardano ecosystem.

Cardano Native Tokens vs. EVM Chain Tokens

The most significant difference between CNTs and tokens on EVM chains (Ethereum Virtual Machine) lies in their foundational architecture. EVM tokens are based on smart contracts that outline the rules for their creation, transfer, and burn. This adds a layer of complexity and potential vulnerability, as the security and functionality of these tokens are only as robust as the smart contracts that govern them.

In contrast, CNTs are integrated directly into the Cardano blockchain, providing several advantages:

- Simplified Creation and Management: Minting and managing tokens do not necessitate smart contracts, though they can be used for advanced functionalities.

- Enhanced Security: Without the need for third-party smart contracts for basic token operations, the risk of vulnerabilities associated with such contracts is reduced.

- Efficiency and Lower Costs: Transactions involving CNTs can be more efficient and less costly, as they avoid the computational overhead associated with smart contracts.

Conclusion

The introduction of Cardano Native Tokens, NFTs, and multi-asset support marked a significant advancement in blockchain technology. By providing a secure and efficient means of creating and managing a wide range of digital assets, Cardano opens new possibilities for developers and users. As the ecosystem evolves, features like Babel fees promise to enhance the utility and accessibility of Cardano's digital assets further, enabling users to pay for transactions using native assets, rather than ADA.